Managing Credit & Borrowing Wisely

Managing Credit as a Student

Understanding credit is an important part of financing your education—especially when considering private student loans. Whether you are building credit for the first time or working to strengthen an existing credit profile, learning how credit works can help you make informed borrowing decisions.

This page provides guidance and resources to help you better understand credit and how it may affect your loan options.

Why Credit Matters

Your credit history can influence:

• Approval for private student loans

• Interest rates offered by lenders

• Whether a co-signer is required

• Long-term borrowing costs

A stronger credit profile may give you access to more favorable loan terms and greater flexibility when borrowing.

If you are new to credit or looking to improve your credit profile, there are steps you can take over time.

Common strategies include:

- Making payments on time

- Keeping balances low relative to credit limits

- Avoiding unnecessary new credit inquiries

- Monitoring your credit regularly

Building credit is a gradual process, but even small steps can make a difference.

How to Build Credit as a Student

Credit doesn’t improve overnight. But with consistent habits, you can strengthen it in 6–12 months.

- Become an Authorized User

Ask a parent or trusted adult to add you to a credit card with:- On-time payment history

- Low balance

- Consider a Secured Credit Card

A small deposit (usually $200–$300) becomes your limit.- Use it for 1–2 monthly purchases

- Pay in full and on time

- Keep Your Utilization Low

Use less than 30% of your available credit – 70% of credit limit still available!

Example: $200 limit → keep balance under $60 - Pay Every Bill on Time

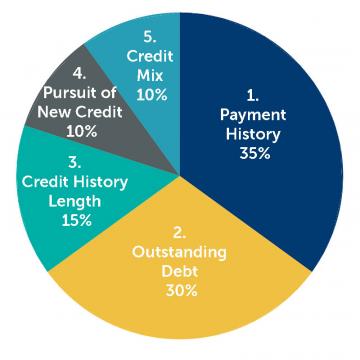

Payment history makes up 35% of your score. - Avoid Too Many Credit Applications

Multiple inquiries in a short time can lower your score. - Consider Rent or Utility Reporting

Paying rent or utilities on time can improve your credit score if you sign up with a service like “Experian Boost”.

Reviewing your credit report allows you to:

- Understand your current credit profile

- Identify errors or inaccuracies

- Track changes over time

Checking your credit report does not affect your credit score and is an important step before applying for a private loan.

How to Check Your Credit

Step 1 — Get Your Free Credit Reports

Go to AnnualCreditReport.com. You can download reports weekly from:

- Equifax

- TransUnion

Step 2 — Review Your Reports

Look for:

- Incorrect late payments

- Accounts you don’t recognize

- Closed accounts listed as open

- Incorrect personal information

- Inconsistencies between the 3 credit reports

Step 3 — Understand Your Score

Typical score ranges:

- 781+: Excellent (best rates)

- 661–780: Good (likely approval)

- 601–660: Fair (likely need cosigner)

- <640: Poor (cosigner always needed)

Step 4 — How to Dispute Errors

Each credit bureau has an online dispute tool. You’ll need:

- A copy of your report

- A short explanation of what’s incorrect

You may choose to apply for a private loan with a co-signer.

A co-signer:

- Shares responsibility for loan repayment

- May help secure a lower interest rate

- Can support approval if you have a limited credit history

If you are considering a co-signer, you should discuss expectations and responsibilities in advance.

When reviewing private loan offers, credit is just one part of the decision.

You are encouraged to carefully compare:

- Interest rates (fixed vs. variable)

- Loan fees

- Repayment options and timelines

- Co-signer release policies

- Deferment and forbearance options

Taking time to compare loans can help you choose an option that aligns with your financial goals.

A Thoughtful Approach to Borrowing

Borrowing for your education is a personal decision. Understanding credit, loan terms, and repayment responsibilities can help you borrow with confidence.

If you have questions about how credit may affect your loan options or want help thinking through next steps, Student Financial Services is available to support you.

Office of Student Financial Services

Student Financial Services is here to assist students and families with managing the cost of higher education and questions about financing your education at Simmons.